BKash is a popular mobile phone-based financial transaction method in Bangladesh, operated through BRAC Bank. In Today's Digital Era, Online payment platforms have become essential for businesses to thrive. bKash, a leading mobile financial service provider in Bangladesh, offers an easy and secure way for merchants to receive payments from customers. This article will guide you through the step-by-step process of creating a BKash Merchant Account, enabling you to expand your business and provide a convenient payment solution to your customers.A BKash Merchant Account is the most updated and feature-rich convenient and secure digital management system for conducting commercial financial transactions.

|

| How To Create Bkash Merchant Account |

How To Create Bkash Merchant Account

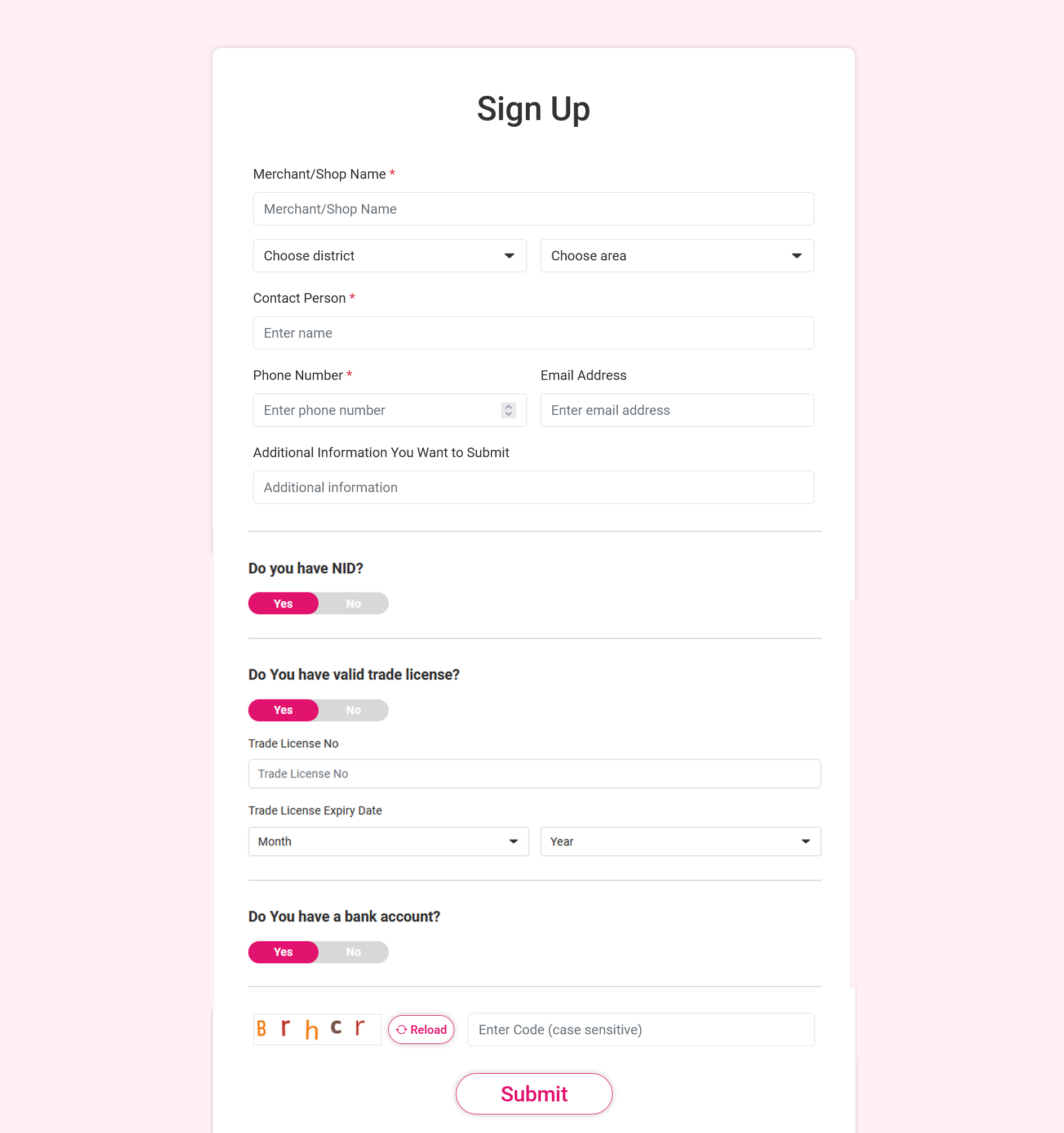

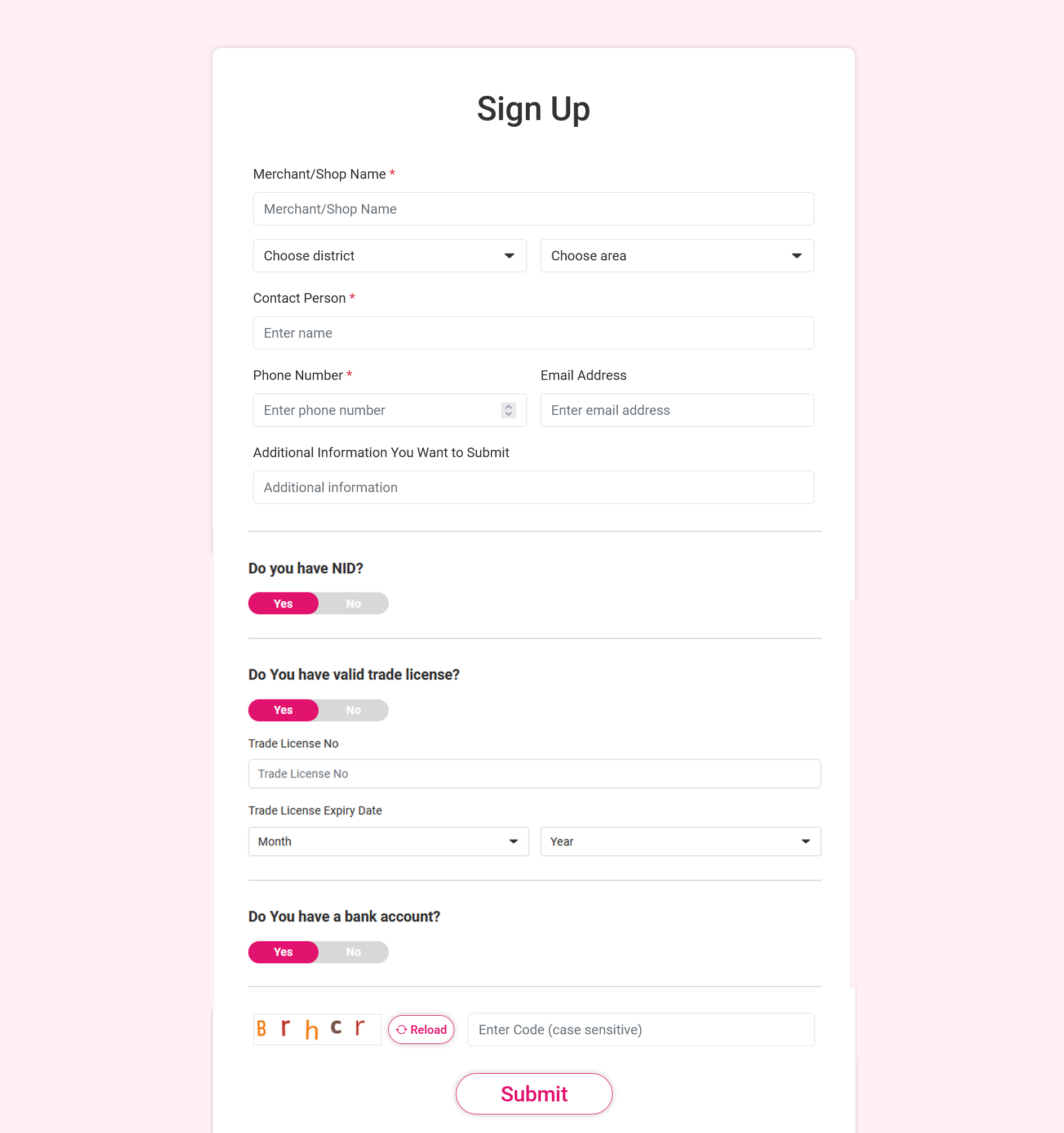

A bKash merchant account offers several additional advantages over a personal or individual account. It is a specialized account designed specifically for commercial financial transactions, making it more extensively used in the business payment & online gateway service. To create or open a bKash merchant account, you need to visit the official bKash website. On the website, click on the "Open a bKash Account" option, and you will find two new options. One is "Agent-based bKash Account," and the other is "bKash Merchant Account." You need to select the bKash Merchant Account option. You will then find a form, as shown in the image below, which you need to fill out accurately with your information.

|

| Create Bkash Merchant Account |

To fill out the application form for opening a bKash Merchant Account, you need to provide the following information as mentioned below:

1. Business Establishment Name: Provide the name of your business if you have one, or any specific name associated with your business establishment.

2. Website Address (if applicable): If you have a website for your establishment or engage in e-commerce transactions, you can provide the link to that website. However, it is not mandatory.

3. Office Address: Mention the location of your main office or the primary office of your establishment. If you have only one office, specify that location. It is crucial to provide the correct address as a bKash agent may visit your office. Incorrect address may lead to a failed account creation.

4. Type of Business Establishment: Specify the type of business you are engaged in and mention the services you provide.

5. Current Address of the Business Establishment: Provide the present location where you are conducting your business. Be cautious not to provide an incorrect address, as it may result in a failed account creation.

6. Monthly Payment Collection Amount (estimated): Provide an approximate estimate of the amount you collect as payments on a monthly basis.

7. Name of the Applicant: If you are the account holder, mention your name.

8. Contact Number: Provide a contact number that allows easy communication with you.

9. Photo ID Number (National ID Card/Smart ID/Passport/Driving License): Provide the number of any one of these documents. Enter the number in the respective box.

10. Trade License Number with Validity: To open a merchant account, you must have a trade license, and it must be valid. Provide the trade license number.

11. Email: Provide your email address. This is a mandatory requirement.

12. Complete the Captcha: Finally, you will see a captcha. It could be a simple math question like (17 + 3 =). Enter the answer in the box provided

13. Submit: Look for an option labeled "Submit" or "Submit Your Form" at the bottom. Click on that option to submit your form.

The above-mentioned bKash merchant form should be filled out correctly and submitted. The bKash authority will review and analyze your bKash merchant account application. If everything is in order, they will provide initial approval officially. Then they will contact you through the mobile number mentioned in the form and request you to visit their nearest bKash Merchant Office. At that time, you will need to bring the prescribed form along with various specified documents for verification. After that, through discussion and final verification, your bKash merchant account service will be activated.

To open a bKash merchant account, you will need the following:

- Any operator's connected mobile phone or smartphone.

- National ID card with a photocopy. (National ID card/Driving license/Passport)

- Two (2) colored passport-sized photos.

- Valid trade license of your establishment.

- An active personal or institutional bank account.

- Tax Identification Number (TIN) (e-TIN number may be required).

- Printed copy of the form filled with the information mentioned on the bKash website.

Bikash Merchant Account Transaction Charges and Limits

The cash-out charge for a bKash merchant account is 1.70%, whereas the cash-out charge for a bKash personal account is 1.85%. There is no transaction limit or restriction on a bKash merchant account. You can perform transactions starting from BDT 1 and there is no maximum limit. You have the freedom to carry out transactions as per your requirements.When you use a bKash merchant account, you will have slightly more advantages and benefits compared to a personal account. The cash-out charge for a bKash merchant account is slightly lower than that of a bKash personal account.

Bikash Merchant Account Benefits

- No limits on the number of merchant accounts: You can open multiple merchant accounts using the same ID.

- No transaction limit: There is no minimum or maximum transaction limit for bKash merchant accounts. You can perform transactions starting from BDT 1 and there is no maximum limit.

- Offer promotions for your business: You can create various offers to boost the sales of your products or services through bKash. You have the flexibility to run bKash offers specifically tailored to your establishment.

- Direct fund withdrawal to your bank account: You can transfer funds from your bKash merchant account directly to your bank account (charges apply).

- Receive payments through your own website and app: You can receive payments through your own website or mobile app using the bKash payment gateway.

Disadvantages of Bkash Merchant Accounts

When using a merchant account, you can only receive payments from personal accounts and personal retail accounts. This means you can receive payments, but you cannot receive funds from other merchants or agents.

You cannot perform immediate or instant cash-out from a merchant account. The only method available for cash-out or fund withdrawal from a merchant account is through bank transfer. So, after requesting a bank transfer, you can withdraw the funds once they are deposited into your bank account.

Note: The instructions provided are a general guideline based on the

given information. It is always recommended to visit the official bKash

website for the most accurate and up-to-date instructions and form.

Disclaimer Notice : Efforts have been made to present and update the above information as

accurately as possible from various sources on the internet and other

references. However, the designated authorities may be responsible for

different types of changes, modifications, and unintended errors in

storing or presenting the information. If you require extremely urgent

and completely accurate information, please request a visit to the

designated website.The mentioned information will fulfill only your

informational demand. No liability will be accepted by the responsible authority.

You can connect with us: Facebook Page ।। Facebook Group

If

your have any quarry or would like to know more about the above

information, please comment and share to give others the opportunity to

learn as well.

0 Comments: